The overview of the accounting cycle includes the systematic process of identifying, recording, and analyzing financial transactions to create accurate financial statements. It provides a structured framework for companies to follow in order to ensure the integrity and reliability of their financial information.

The importance of following the accounting cycle cannot be overstated. By adhering to this process, companies are able to maintain accurate financial records, which is crucial for making informed business decisions, complying with regulatory requirements, and demonstrating financial transparency to stakeholders.

The accounting cycle plays a vital role in financial management by providing a clear structure for organizing financial data and generating key reports such as the income statement and balance sheet, which are instrumental in evaluating the financial performance and position of a business.

How important are the steps in the accounting cycle?

The accuracy of recording transactions and maintaining financial data has a direct impact on the preparation of financial statements. This, in turn, affects the analysis and decision-making process for the company’s management, investors, and other stakeholders.

Efficiency and automation play a significant role in the accounting cycle as they streamline the entire process, allowing for quick and accurate financial reporting. This enhances the company’s ability to respond promptly to changing business dynamics.

Ensuring compliance and financial reporting is a critical aspect of the accounting cycle. By following the prescribed steps, companies can accurately report their financial performance and ensure compliance with relevant accounting standards and regulations.

How does accounting software automate the accounting cycle?

Accounting software integrates various accounting processes, including recording transactions, maintaining the general ledger, and generating financial reports. This automation streamlines the entire accounting cycle, improving accuracy and efficiency.

Furthermore, accounting software streamlines the trial balance and financial statement generation, simplifying the process for businesses. It also provides real-time access to financial data, enabling informed decision-making.

Using accounting software for journal entries and general ledger maintenance not only simplifies the process but also reduces the likelihood of errors, providing more reliable financial information for the company’s stakeholders.

What is the purpose of the accounting cycle in small business accounting?

The accounting cycle plays a crucial role in managing financial transactions for small businesses. It provides a structured framework for recording and summarizing financial activities, ensuring accurate financial reporting and compliance.

Furthermore, the accounting cycle is essential in preparing balance sheets, which are vital in assessing the financial position of a small business. It also helps in generating income statements, providing a clear picture of the company’s profitability over a specific period.

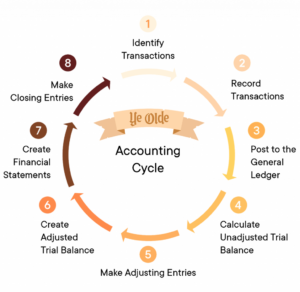

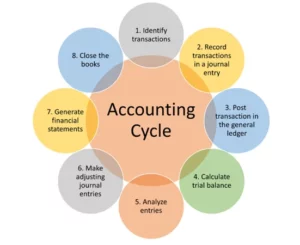

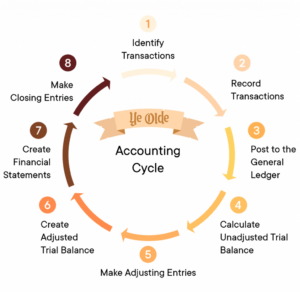

The 8 Steps of the Accounting Cycle

The eight steps of the accounting cycle include the following:

Step 1: Identify Transactions

The first step in the accounting cycle is identifying transactions. Companies will have many transactions throughout the accounting cycle. Each one needs to be properly recorded on the company’s books.

Recordkeeping is essential for recording all types of transactions. Many companies will use point of sale technology linked with their books to record sales transactions. Beyond sales, there are also expenses that can come in many varieties.

Step 2: Record Transactions in a Journal

The second step in the cycle is the creation of journal entries for each transaction. Point of sale technology can help to combine steps one and two, but companies must also track their expenses. The choice between accrual and cash accounting will dictate when transactions are officially recorded. Keep in mind that accrual accounting requires the matching of revenues with expenses so both must be booked at the time of sale.

Cash accounting requires transactions to be recorded when cash is either received or paid. Double-entry bookkeeping calls for recording two entries with each transaction in order to manage a thoroughly developed balance sheet along with an income statement and cash flow statement.

Generally accepted accounting principles (GAAP) require public companies to utilize accrual accounting for their financial statements, with rare exceptions.1

With double-entry accounting, each transaction has a debit and a credit equal to each other, common in business-to-business transactions. Single-entry accounting is comparable to managing a checkbook. It gives a report of balances but does not require multiple entries.

Step 3: Posting

Once a transaction is recorded as a journal entry, it should post to an account in the general ledger. The general ledger provides a breakdown of all accounting activities by account. This allows a bookkeeper to monitor financial positions and statuses by account. One of the most commonly referenced accounts in the general ledger is the cash account which details how much cash is available.

The ledger used to be the gold standard for recording transactions but now that almost all accounting is done electronically, the ledger is less of an active concern as all transactions are automatically logged.

Step 4: Unadjusted Trial Balance

At the end of the accounting period, a trial balance is calculated as the fourth step in the accounting cycle. A trial balance tells the company its unadjusted balances in each account. The unadjusted trial balance is then carried forward to the fifth step for testing and analysis.

This is the first step that takes place once the accounting period has ended and all transactions have been identified, recorded, and posted to the ledger (this is usually done electronically and automatically, but not always).

The purpose of this step is to ensure that the total credit balance and total debit balance are equal. This stage can catch a lot of mistakes if those numbers do not match up.

Step 5: Worksheet

Analyzing a worksheet and identifying adjusting entries make up the fifth step in the cycle. A worksheet is created and used to ensure that debits and credits are equal. If there are discrepancies then adjustments will need to be made.

In addition to identifying any errors, adjusting entries may be needed for revenue and expense matching when using accrual accounting.

Step 6: Adjusting Journal Entries

In the sixth step, a bookkeeper makes adjustments. Adjustments are recorded as journal entries where necessary.

Step 7: Financial Statements

After the company makes all adjusting entries, it then generates its financial statements in the seventh step. For most companies, these statements will include an income statement, balance sheet, and cash flow statement.

Step 8: Closing the Books

Finally, a company ends the accounting cycle in the eighth step by closing its books at the end of the day on the specified closing date. The closing statements provide a report for analysis of performance over the period.

After closing, the accounting cycle starts over again from the beginning with a new reporting period. Closing is usually a good time to file paperwork, plan for the next reporting period, and review a calendar of future events and tasks.

What Are Some of the Advantages and Disadvantages of Accounting?

Some advantages of accounting are that it provides help in taxation, decision making, business valuation, and provides information to important parties like investors and law enforcement. Some disadvantages are that the information may be biased, can be estimated to a degree, can be manipulated, and that the units used to measure business performance, namely cash, change in value.

The Bottom Line

The eight-step accounting cycle process makes accounting easier for bookkeepers and busy entrepreneurs. It can help to take the guesswork out of how to handle accounting activities. It also helps to ensure consistency, accuracy, and efficient financial performance analysis.